One of the scariest books I ever read as a kid was Stephen King’s IT. Why I was allowed to read such a scary book at the age of 12 is debatable, but even now, almost 30 years later, that book still gives me chills. I am reminded of the book since a new movie version of the story is set to be released this year. It got me thinking about real-life fears and real-life debts.

Like any good horror story, there is a certain amount of culpability involved with the “victims” of whatever is lurking. Maybe they choose to walk into an abandoned house or have the audacity to be underage teenagers kissing in the woods, or, as is the case in “IT,” maybe the main characters chose to explore sewer drains. Whatever the reason, the adversity that befalls these individuals, isn’t always completely outside of their control. Such is the life of a creditor.

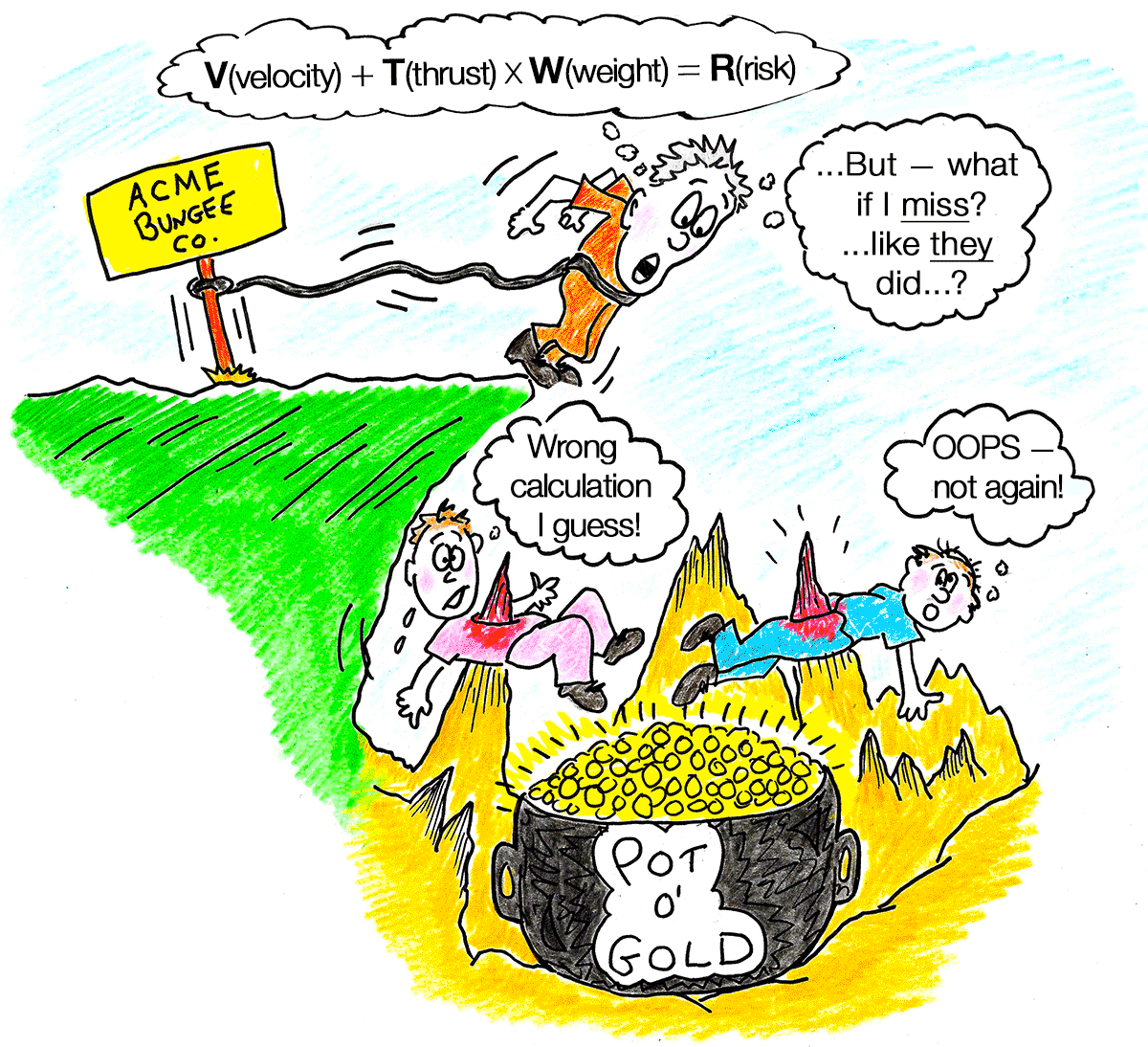

While there will be factors that cannot be controlled, I find all too often that the tools that are available to mitigate bad debt are either ignored or sidestepped for the sake of convenience, or even worse, pure laziness. Do some research, weigh the risks, and check your measurements twice before jumping for that pot of gold.

Our question for the month of September:

What one tool is absolutely essential in determining the risk of a potential customer BEFORE a line of credit is extended?

LET PICB HELP WHERE OTHERS HAVE FAILED!

CREDIT RISK ASSESSMENT!

PROFESSIONAL COLLECTIONS TEAM!

DECADES OF EXPERIENCE WITH PRINTING INDUSTRY CREDIT AND COLLECTIONS!

FISHY TALES PRIZE RULES -2017

There are no scales or hooks necessary, and you do not need fins or even an ability to swim to win.

Who is eligible? — Anyone and everyone except employees of Professional Credit Management Associates, Inc. dba Printing Industry Credit Bureau and Checkitco Company (PICB), along with their children and/or relatives, may enter to win.

When does this promotion end? Each month there will be a new Fishy Tale challenge posed to subscribers of PICB’s Where’s the Money Newsletter. PICB may end this challenge at any time and without notice.

WHAT IS THE PRIZE? Free Credit Risk Assessments worth $85.00 provided each month, and a one-time monetary prize of $500.00 awarded to the one respondent who won the most CRAs from Jan. 2017 – Nov. 2017.

WHAT IS CRA? CRA – PICB’s unique report is intended for credit grantors to use in support of making wise credit choices and is built using current records filed with various governmental agencies and are available under ‘Public Records’. PICB purchases no existing report to re-sell it, We actually do the old fashion method of real time research using the 21st century modern tools.

HOW DOES THE GAME WORK? The answers to the challenge are speculative – there is no one correct answer, therefore the winners will be those first 3 respondents who provide a ‘solution’ and meet the eligibility requirements as stated above.

HOW DO I SUBMIT MY SOLUTION? Post your answer directly on the Newsletter ‘answer box’, make sure and identify your name and company name, we will then notify you if you were one of the first 3 respondents via email and award you your Fishy Tale redemption coupon.

WHEN CAN I REDEEM THE COUPON? Anytime by submitting a CRA request, make sure and provide your redemption coupon at the time of submission and we will provide you the requested report. CRA redemption coupons may not be claimed for the cash equivalent.

WHEN WILL THE GRAND PRIZE BE PAID OUT? $500.00 will be paid to the individual or company who has entered the most winning challenge answers between Jan. 2017 thru Nov. 2017 and the cash prize will be paid prior to December 31st, 2017

For more information contact PICB at 847/265-0400 or [email protected]