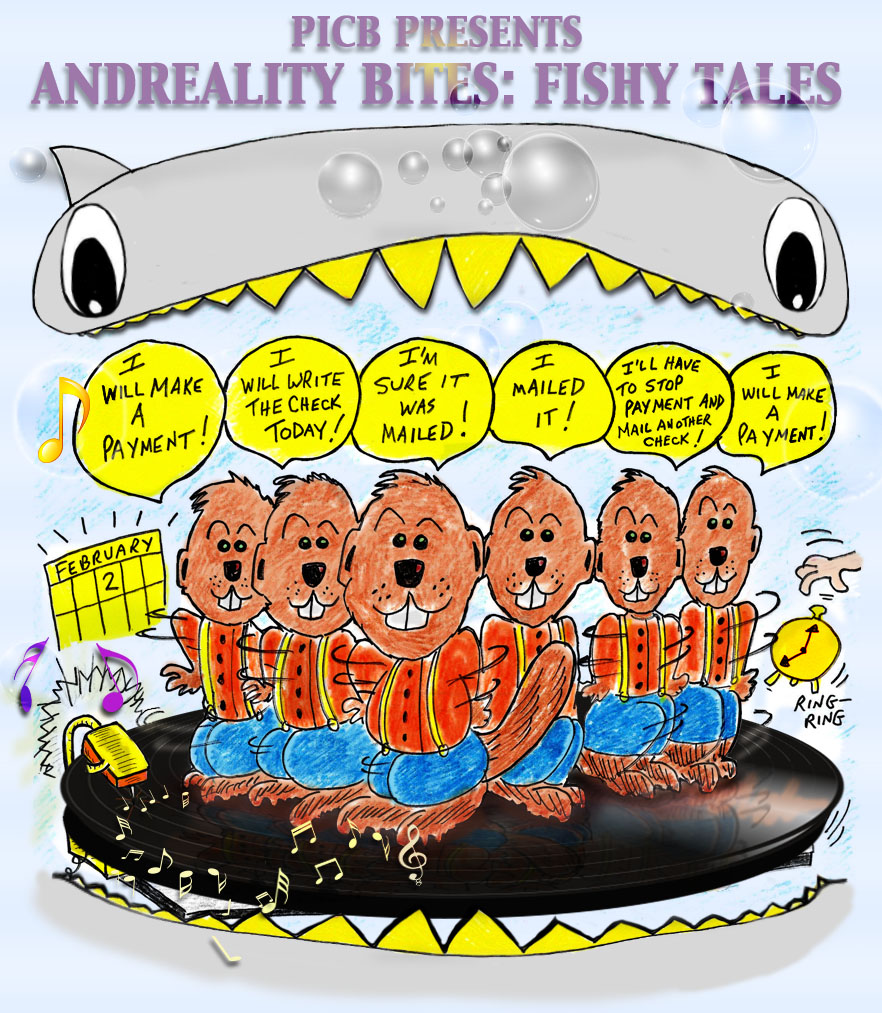

FISHY TALES

June’s Challenge:

What Would You Do?

Did the music skip or is the Record Broken?

Records skip and repeat because of flaws such as cracks or scratches, but sometimes it isn’t the record at all. Sometimes it’s the needle or the player itself that needs to be replaced. When problems arise solutions aren’t always obvious, and extenuating circumstances can play a part in finding the nuance to any issue.

Recently a Member retained PICB to collect from a non-paying customer who had been promising payment for nearly 3 years. Flummoxed, and not knowing what to do, he explained this was the first time a customer had not paid for services. He considered his customer a friend because they had worked together successfully for many years.

The Customer, like the Member, had been very successful for more than 30 years, and worked collaboratively to build strong businesses – WHICH THEY ACHIEVED — until 2009 when the customer, like so many others, found himself crushed by the recession. Rather than just close his doors, and walk away, he looked to negotiate the sale of his company. He found a venture (vulture) group willing to pay enough to resolve all company debts and still leave a little to retire with. The customer believed the process to be ethical, happily shared the sale documents with his vendors, and excitedly told everyone they would be paid as soon as the deal closes!

The Vulture group kept delaying the closing for more than a year. Each delay caused the Customer to make another promise that did not materialize. He lost credibility. His company was being devalued and eroded, yet he believed the sale was imminent. His most stalwart supporters like our Member were waning In their support – but he KNEW the sale would happen any day now!

Sadly, the customer never saw the Vulture’s deception until the bank foreclosed. His lawyer discovered that all the stalls and delays were premeditated, and the Vulture had been secretly negotiating with the bank. They preyed on the customer’s remains by promising the bank payment for the assets post foreclosure for pennies on the dollar. The bank would be made whole, but only at the expense of everyone else.

The Customer has since sued the bank and the Vulture for their unfair business tactics which will languish in court several more years. He has since found another buyer, but the foreclosure action is creating issues on closing this sale and EVERY VENDOR IS STILL UNPAID!

So here is a the broken record conundrum. What do you do when a long, well established relationship with a trusted customer becomes broken?

SOLVE THIS FISHY TALE

Be the first to answer and win a FREE CRA report now.

GRAND PRIZE BE PAID OUT

$500.00

See Fish Tales Prize Rules

Hey Andrea,

Just wanted to let you know that I used your “Check It” links for a new/potential customer. His company had a tax lean. I asked him for a credit card up front and it got declined. You saved me! A simple google search didn’t find the tax lean.

Many Thanks! And LLAP!

Patrick